| All Systems Go in the Wind Business |

|

| Thursday, April 30, 2009 | |

Page 2 of 3

Mission Possible? Wind Energy Gets its Marching Orders from Government Targets Creating today’s intense demand for wind energy is growing awareness of the economic dangers of oil dependency and the threat of global warming, which have led to a range of economic incentives and renewable energy mandates set by governments worldwide. Now viewed as the most mature and proven of all renewable technologies, governments are backing wind as the engine for their ambitious renewable energy goals. For example, the EU aims to get 20% of its energy from renewable sources by 2020, with wind contributing 12-14%. China is seeking 15% of its electricity from renewables by 2020. Hydroelectric power will contribute the biggest share, but wind energy is exceeding expectations and has already blown past its goal of 5 GW by 2010. The feasibility of ambitious wind energy goals set by governments and states worldwide appears to be supported by research such as the U.S. Department of Energy’s (DOE) May 2008 report, which concluded that wind power is capable of accounting for 20% of U.S. electricity by 2030. In June 2008 the International Energy Agency (IEA) released Energy Technology Perspective, which acknowledged that wind power would play the major role in reducing emissions in the power sector in the next 10-20 years. In one scenario, IEA forecast that wind energy could account for up to 17% of global power production by 2050. All this adds up to unprecedented opportunity for wind turbine manufacturers, subcomponents suppliers, wind farm developers, and providers of adjunct products and services. Executives interviewed for this issue generally agreed that lofty goals are attainable for wind, but only with greater and more consistent government support, in addition to massive infrastructure investment in national grids worldwide: two very big ‘ifs’. In the short term, some urgent but more manageable challenges, notably supply chain shortages and rising commodity and component prices, threaten to inhibit growth in an industry promoted as one of the cheapest and fastest energy sources to bring on line. To reap the most from this period of high demand for wind energy, which looks set to continue for the next several years, global players up and down the manufacturing supply chain are engaged in record levels of capacity expansion, reaping the fruits but also the challenges of excess demand. Meanwhile, large wind farm developers, including utilities, are acquiring and investing globally in project pipelines, consolidating the wind generation sector at an unprecedented rate. Soaring revenues illustrate the rapid growth of wind turbine sales, worth 25 billion euros ($40 billion) in 2007, according to the Global Wind Energy Council in Brussels. Nordex of Germany, for example, projected revenues of €1.1 billion by 2008 year’s end, an increase of nearly 50% following 45% growth in 2007. India’s Suzlon Energy’s revenue rose 71% to $3.19 billion in its financial year ended March 31 2008. Vestas Wind Systems A/S of Denmark, the world’s largest turbine manufacturer, with an estimated 23% marketshare, increased its revenue by around €1 billion to €4.861 billion in 2007 and forecast revenue of EUR 5.7 billion for 2008. To meet record requirements for wind turbines, manufacturers have been investing heavily in factories worldwide, particularly where markets are moving fastest, notably in the U.S. and China, where wind power grew 45% and 145%, respectively in 2007, according to the Global Wind Energy Council. |

Submitted by Singapore

AIM

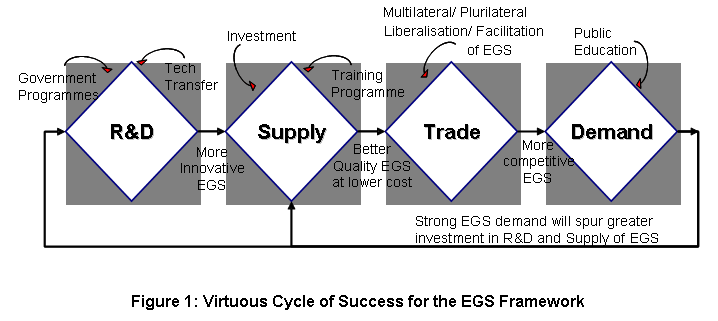

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...