|

Indonesia: Water Supply and Distribution Systems Industry |

|

|

Tuesday, July 21, 2009 |

The Indonesian Statistics Institute (BPS) estimates the value of the water supply industry at $440 million rupiahs in 2006 thus registering over 43% growth since 2003.

Indonesia currently has over 300 municipal owned water enterprises (PDAMs), comprised of 8 large-scale PDAMs (over 50,000 house connections) and 77 medium-scale PDAMs (10,000 to 50,000 house connections). The balance is made up of small-scale PDAMs serving fewer than 10,000 house connections.

Water tariffs generally do not cover operating and maintenance costs, and average loss of water to non revenue use is high. Many PDAMs are too small and inefficient to maintain controlling staff. Many do not have an asset management system and 30% have no accountant. There has been no significant asset investment over the past 10 years. Responsibility for water supply and sanitation rests with the regional governments, but new lending is blocked by PDAM and regional government loan arrears. Although PDAMs can increase water tariffs, local politicians often control tariffs for political ends, with PDAMs frequently used to finance local projects.

Indonesia: Water Supply and Distribution Systems Industry. By Aulia Rochaini. September 08. U.S. Commercial Service.

Jakarta and a number of other larger systems provide exceptions to municipal operation in the form of private sector concessionaires, PT Aetra Air Jakarta (Aetra) formerly PT. Thames and PT. PAM Lyonnaise Jaya (PALYJA). They each supply potable water and are responsible for all treatment, distribution, recording and billing.

The best sales prospects for U.S. products in water supply and distribution systems are valves, pumps and meters. Indonesia’s water and industrial pumps market represents growing potential for U.S. exporters. U.S. firms generally lose their competitiveness in the market of pipes and fittings due to the price differences. The types of pipe currently in use in Indonesia are asbestos cement (AC) pipes, mild steel pipes, ductile iron pipes, cast iron pipes, Polyethylene (PE) pipes and PVC pipes.

The 2006 total domestic market for water and industrial pumps was $862 million, with a total import of $778 million, local production of $213 million and exports of $129 million. If the domestic and export markets remain stable, it is predicted that the growth of total domestic demand will increase by 10 to 15 percent annually over the

next five years.

Click here for full text

|

Submitted by Singapore

AIM

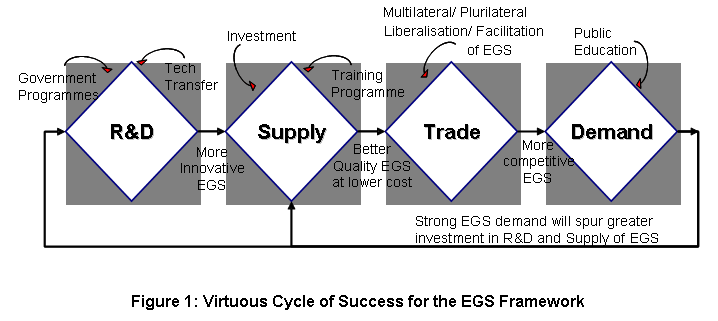

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...