| Environmental Consulting & Engineering Client Categories and InterSegment Interactions |

|

| Thursday, April 30, 2009 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Environmental Consulting & Engineering market and business segments by client or customer, service and media.

SOURCE: Environmental Business International Inc. 3.1.4 Intra-Industry ClientsAs mentioned previously, firms in most of the thirteen segments have, in addition to outside government and private customers, clients and suppliers within the environmental industry itself. The interactions between the C&E segment and each of the twelve other environmental industry segments are discussed here and are summarized in Exhibit 12. ANALYTICAL SERVICES Although many engineering and consulting firms maintain their own laboratories and analytical service units, analytical services firms are often contracted by C&E firms to perform tests necessary for remedial investigations, feasibility studies and site assessments. Generally, analytical service firms do not purchase services from C&E firms. SOLID WASTE MANAGEMENT C&E companies do not purchase solid waste management services. Solid waste firms do, however, rely on C&E firms for waste characterization and landfill and facilities design. HAZARDOUS WASTE MANAGEMENT Hazardous waste management firms are the prime contractors for treatment and transportation projects involving hazardous wastes. Hazardous waste companies contract with C&E firms for partnerships and front-end support in RCRA and other hazardous waste projects. REMEDIATION/INDUSTRIAL SERVICES Remediation companies are the prime contractors for C&E firms in projects involving cleanup of contaminated sites. C&E firms consult with remediation firms on cleanup regulations, technologies and remediation process design. CONSULTING/ENGINEERING C&E firms are often engaged in subcontracting and partnership relationships with other firms in the industry (almost 25% of C&E revenues are generated from subcontracts from other C&E, E/C, remediation of other environmental firms). WATER EQUIPMENT AND CHEMICALS Consulting firms subcontract from the water and wastewater treatment industry for ongoing operations and maintenance services for the facilities they design and manage. Consulting firms design treatment facilities, equipment and systems for industrial water treatment and storm water management. INSTRUMENT MANUFACTURING C&E firms purchase monitoring equipment and analytical instruments from instrument manufacturers for use by their employees on projects. AIR POLLUTION CONTROL EQUIPMENT & WASTE MANAGEMENT EQUIPMENT Consultants buy air pollution control equipment and waste management equipment to use in projects for generators. APC and waste management equipment manufacturers also use C&E firms for facilities and process design. PROCESS & PREVENTION TECHNOLOGY Increasingly, C&E firms are focusing on pollution prevention and waste minimization techniques in their work with generators. As a result, consultants are purchasing or recommending for purchase systems and technologies designed to reduce pollution volumes. The design of these process and prevention technologies are, in turn, often influenced by C&E firms who are hired for their intimate knowledge of industry trends and regulatory issues. WATER UTILITIES Water utilities supply water delivery services through C&E companies as project managers to their facilities and their project sites. C&E firms design delivery systems and facilities for water utilities. RESOURCE RECOVERY Resource recovery services are generally not bought by C&E firms. C&E firms are engaged by resource recovery companies to design systems and facilities. ENVIRONMENTAL ENERGY SOURCES Environmental C&E firms frequently use energy firms' products in their work and occasionally, will serve as a distribution channel for environmental energy and conservation products. Energy companies use C&E services such as investigatory services, site assessments, environmental impact statements (EIS) and feasibility studies, as well as system and facilities design. Exhibit 12 Environmental Industry Segment Interactions

SOURCE: Environmental Business International Inc. 3.2 Environmental C&E Markets by Service TypeSection 6.2 contains a detailed analysis of large C&E, mid-size C&E and small C&E firm consulting revenues by service type. Service types analyzed for this study were divided into 8 categories reflecting the dominant activities performed by C&E firms. They are: • Investigation/Assessment/Auditing • Design • Project Management • Permitting/Compliance • Testing/Lab Services • Pollution Prevention/Waste Minimization • Strategic Environmental Management Consulting • Other INVESTIGATION/ASSESSMENT/ANALYSIS/AUDITING Pertains to the assessment of technical and regulatory environmental considerations associated with any site, project or facility. Includes the analysis and evaluation of environmental risk, regulatory compliance issues, contaminated property and remedial investigation/feasibility studies (RI/FS), wastestreams, pollution volumes and control technologies, energy efficiency and natural resource assets. DESIGN Includes all "front-end" process, facility and project design services usually related to a specific project such as an implementation of a pollution control technology, designing a remediation or cleanup project, designing a land restoration project, designing a hazardous waste tracking, manifesting and management system or designing a wastewater treatment system. Project design work is analogous to a blueprint for project execution or construction of a bridge or other structure in the civil engineering discipline. PROJECT MANAGEMENT Includes services pertaining to the overall management of the execution or construction of environmental projects and may include oversight of multiple third party contracts. This component accounts for the specialist environmental work which may be associated with a larger construction project which is external to the market size quantification of this business segment. This category also includes operation & maintenance (O&M), a service sometimes separated out in EBI analysis. An example of O&M would be contract operations to manage a wastewater system for some time period. REGULATIONS/PERMITTING/COMPLIANCE Includes services intended to assist clients in the fulfillment of environmental regulatory, reporting and permitting requirements including the actual paperwork and filing associated with permits, fines, etc. This also includes supporting government agency regulatory programs in implementation and enforcement. TESTING/LAB SERVICES Includes all laboratory, field and mobile testing services. Also includes sampling procedures. POLLUTION PREVENTION/WASTE MINIMIZATION Pollution prevention (P2) is the preventative and process-oriented technical/engineering services leading to waste minimization at the plant or process level. P2 is most frequently associated with retrofit projects in EBI analysis as it is very difficult to separate out the environmental components of an entirely new facility or factory although these are occasionally assigned separately. STRATEGIC ENVIRONMENTAL MANAGEMENT SEM consists of a set of comprehensive services offered at the executive level to define, support and help implement system-based, proactive environmental policies at all corporate levels, leading to pollution prevention, operating efficiency, market positioning and sustainable production practices. SEM--which effects a move from end-of-the pipe controls to virtually all areas of corporate planning, production, resource use, marketing, accounting and training--can include traditional consulting/engineering processes implementing P2 and waste minimization in conjunction with management consulting. Approaches could include: information system integration, full-cost accounting, process re-engineering and methods to obtain independent environmental certification (e.g. CERES principles and ISO 14000). SEM will increasingly represent and take over some parts of the service categories above but provided that these are organized and delivered in a coordinated management rather than purely technical approach. OTHER SERVICES Other includes services unaccounted for above such as litigation support, expert testimony, ecosystem modeling, etc. Exhibit 13 presents a simplified view of the market for primary C&E services by mapping them against the primary environmental media categories (also to be discussed in much greater detail later in this section). Exhibit 13 places service markets and media markets in a matrix that briefly illustrates the relative importance (in terms of revenue) of the main C&E service areas according to each media category. Each cell of the matrix represents a particular service/media mix and the black dots indicate the relative size of each of these submarkets. The larger the dot, the greater the significance of that particular micro-market in the overall C&E market in terms of current revenue generation.

SOURCE: Environmental Business International Inc. 3.3 Environmental C&E Markets by Environmental MediaDividing the environmental C&E market into media segments is probably the most common form of segmentation by firms in the business. Client demand, personnel expertise and regulatory and compliance issues have historically been divided along media lines. However future trends point to less emphasis on media as the guiding basis of regulation and compliance and more to industry-specific multi-media approaches. The contemporary environmental C&E business continues to evolve from its original roots among individual engineers and general engineering firms of various sizes. Previously specializing in various media or services, firms began to combine resources and expertise by banding together to form more integrated service providers. In other words there were wastewater and sewage firms, air quality engineers, solid waste experts, industrial hygiene specialists and so on in a rarely connected field of environmental consulting. The past 20 years have seen a gradual consolidation of these activities, and although the market remains highly fragmented, firms with multi-media expertise now dot the landscape. However, even the largest C&E firms, many of whom have put considerable effort into diversification and positioning themselves as turnkey contractors for a number of industries in a number of media, are often known for a particular area of expertise. Firms are usually characterized as a government contractor or are well known in a particular geographic region but more often they are regarded as a hazardous waste firm, a water company or an air company. Specialization has returned to popularity as a positioning tool – to some extent in response to the need for differentiation in marketing. At the same time, many firms still continue to seek to add to the number of disciplines in which they specialize. Regardless, the market and particular leaders will continue to have media focus. EBI recognizes eight primary media categories that account for the vast majority, if not all, of C&E firm work. These eight categories are defined below: HAZARDOUS WASTE MANAGEMENT applies to the management of ongoing waste streams. Includes consulting and engineering services related to hazardous waste treatment, storage, transportation and disposal, design and permitting of hazardous waste-related facilities (such as landfills, TSDs, incinerators, etc.) and characterization studies. REMEDIATION applies to consulting and engineering work associated with cleanup of contaminated sites. Includes the “front-end” portion of soil & groundwater cleanups such as preliminary site assessments, analytical testing work, RI/FS and remedial design. The market numbers in this report exclude remediation construction work which fall into EBI’s remediation segment which are broken down and analyzed to similar detail in EBI Report 310, a market briefing on remediation and industrial services. SOLID WASTE MANAGEMENT involves waste characterization & rate studies (and other financial/economic types of work), recycling programs and design of solid waste management facilities (materials recovery facilities, transfer stations, landfills, composting projects, incinerators and waste-to-energy (WTE) plants). WASTEWATER TREATMENT includes consulting & engineering related to industrial pre-treatment, sludge management, design and O&M of wastewater treatment facilities (such as POTWs or the contract operations business), compliance related services (such as permitting assistance), consulting on treatment & disposal and design/construction management of stormwater management and sewerage systems. WATER PURIFICATION & DELIVERY pertains to the design of drinking water delivery systems mostly the responsibility of public and private sector water utilities as well as O&M of water utility and purification facilities. This also involves design and management of systems for industrial water purification for use. ENERGY EFFICIENCY involves consulting on energy efficiency and demand side management (DSM), design and O&M of co-generation systems, the design of alternative/renewable energy generation systems (such as wind, solar, geothermal, etc.). AIR QUALITY work includes air emissions study, modeling, compliance related services (such as permitting assistance), and C&E related to installation of air pollution control (APC) systems (such as scrubbers & precipitators at utilities and WTE plants, etc.) Also includes APC related work in design of industrial facilities such as petroleum refineries and chemical processing plants. NATURAL RESOURCES includes delineation, mapping, impact assessment and design related to the management of wetlands, forests, watersheds, oceans, estuaries and other natural resources. This also includes ecosystem, park and wildlife studies and management.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

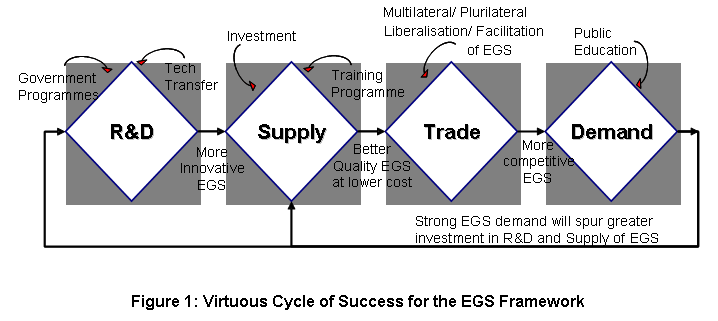

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...