Environment to Thailand

Trends and opportunities

The market

Thailand’s market for environmental technology, with an estimated value of A$3 billion per year, has been lucrative for Australian environmental technology firms. It is expected that the industry will grow at 5–10 per cent per annum.

Factors driving the growth of environmental technology markets include:

* Poulation growth

* Rapid industrialisation and urbanisation

* Increasing public awareness

* Enforcement of regulations

* Strengthened legislation

* Privatisation policy

Expansion of the environmental industry relies on the technology and expertise of foreign products and services. Locally made products meet general standards for environmental needs, but specialised products must be imported. About 70 to 80 per cent of environmental equipment is imported each year.

Opportunities

The need to solve environmental problems is still a key priority for the Thai Government and the government is enthusiastic about privatising as many projects as possible.

Publicly funded, World Bank, and Asian Development Bank (ADB) projects drive opportunities with an emphasis on build, own, operate (BOO) and build, operate, transfer (BOT) projects. Accelerated privatisation projects will present long-term commercial opportunities for the sector.

The Thai environmental technology sector’s high priority needs include:

* Water/wastewater:

o Privatisation projects, which will create opportunities in engineering, management consultants, contractors, and operators with build, own, operate (BOO) and build, operate, transfer (BOT) concessions

o Pumps (submersible, centrifugal, aerator/mixer, dosing and vacuum), sludge dewatering equipment (filter presses, belt press, small dewatering systems) and screening machines (bar screens, shredding screens)

o Groundwater, water resources management

o Municipal and industrial wastewater treatment plant management and operations

o Consultants and contractors, operators, equipment manufacturers and financiers in supply, maintenance and operational training

* Solid waste:

o Municipal solid waste management

o Waste handling equipment

o Recycle technology (including biomass)

o Sorting equipment

o Landfill equipment

o Incinerators

o Biological waste treatment

o Hazardous waste treatment

o Medical waste management

o Solid waste management system and clean technology

* Air/emissions management:

o Urban emissions management

o Industrial emissions management

o Air monitoring equipment

o Industrial continuous-emission monitoring equipment

o Indoor air pollution control equipment\

o Vehicle emission monitoring systems

o Odour control

* Energy:

o Renewable energy

o Biogas, biofuels, biomass

o Energy efficiency

The Bangkok Metropolitan Administration (BMA) is:

* Supporting private sector participation in the management and operation of 8000 tonnes of municipal waste per day in the Bangkok area

* Implementing five central wastewater treatment plants, which have the capacity for 842,000 cubic metres per day and covering an area of 158.34 square kilometres

* Intending to privatise all future wastewater treatment projects (cover an area of 199.7 cubic kilometres) in terms of investment, and operation and maintenance

The Petroleum Authority of Thailand (PTT) is:

* Promoting the use of natural gas as an alternative fuel in transport

* Implementing a A$105 million five-year plan to establish 30 natural gas service stations and to promote the expansion of natural gas consumption in the industrial sector around Bangkok and its suburbs.

The provision of environmental consulting services and air pollution control equipment remains an ongoing opportunity.

Competitive environment

Public agencies, such as the Public Works Department (PWD), local administrations and municipalities tend to let contracts to Thai-based consultancies and contractors. Serious competition is not always practised and local political and bureaucratic figures may be extremely influential in decision-making processes.

Other public agencies such as BMA, the Ministry of Natural Resources and Environment (MONRE), and the Industrial Estates Authority of Thailand (IEAT) are becoming increasingly reliant on international contractors and consultants that are amenable to forming partnerships with Thai companies, while bringing competitive skills and expertise to clients.

The Ministry of Natural Resources and Environment (MONRE), which includes the Office of Environmental Policy and Planning (OEPP), the Wastewater Management Authority (WMA) and the Pollution Control Department (PCD), is the key agency for environmental projects, providing finance, regulations, research and direction.

Executing agencies, such as the Bangkok Metropolitan Administration (BMA), implement and manage projects.

Metropolitan Waterworks Authority (MWA) and the Provincial Waterworks Authority (PWA) have invited the private sector to participate in several build, own, operate (BOO) and build, operate, transfer (BOT) projects, to cope with the rapidly growing demands for water supply. PWA is implementing five BOT and three BOO water supply privatisation projects worth an average A$50–80 million each.

back to top of siteback to top

Tariffs, regulations and customs

Thailand has no barriers against entry of foreign services or equipment used for environmental projects. Neither import restrictions nor specific technical standard requirements exist to regulate importation of water resources equipment.

The Thai Government supports the environmental technology market by lowering tariffs to five per cent or less on assembled imports. Products can carry tariffs as high as 35 per cent if the Thai Customs Department does not classify imported equipment as ‘environmental technologies’.

As with other countries, importing equipment is screened by the Customs Department at the port of entry. Product brochures are required for customs clearance and tariff verification. The complete set equipment for environmental problem solving is normally subject to no duty.

Industry standards

Australian products and engineering services have a good reputation for their quality and advanced technology in the field of environmental management services and equipment in Thailand.

International pressures, linked to global and regional environmental concerns, are driving Thailand’s domestic environmental industry. The growing trend towards standardisation under the ISO 14000, 14001 system aims to bring local standards in line with accepted international environmental standards.

Marketing your products and services

Market entry

Most international suppliers of equipment and machinery enter the Thai market by appointing local agents/distributors or opening local offices. Through their local representatives, suppliers can market their products efficiently and economically.

International suppliers rely on the market expertise and the low-cost, local service content provided by the local partner. Local representatives assume full responsibility of marketing the products. In exchange, international suppliers offer high value-added content to the project based on their reputation, past references and expertise. This strategy provides synergy to compete in the market with minimal time and investment.

You are advised to collaborate with local companies to provide consultancy services regarding the environmental industry.

Local companies are eager to work with international partners. They often have to seek international expertise, when working on large-scale projects. Foreign companies work most effectively in Thailand by developing long-term relationships and creating the sense of trust needed to do business in the region.

Major environmental projects are under the responsibility of various Thai Government agencies.

Establishing networks of contacts with local companies and government ministries is essential in gaining access to information about market opportunities. Trade associations (eg. Environmental Engineering Association of Thailand and the Australian-Thai Chamber of Commerce), government-sponsored funding programs, and environmental exhibitions or shows are powerful tools for gaining access to opportunities, contacts and knowledge about the local market.

Consider promoting your companies and expertise to the local engineering community by:

* Organising a seminar for the local consultant community

* Organising personal visits to prospective companies

* Providing marketing support

It is advisable, at a minimum, to publish an ‘online brochure’ on the Internet to reach Thai companies.

The most frequent problem with introducing foreign technology into Thailand is that it is often too advanced or costly to fit market needs and financial capabilities of the country.

The ideal environmental technology marketed in Thailand should be:

* Relatively easy to install or construct

* Have minimal need for after-sales servicing or technical or professional support in operations

* Low levels of ongoing maintenance

Australian companies should also investigate the prospect of opening manufacturing facilities in Thailand in the mid-term. Thailand is an excellent springboard for reaching other growing markets throughout the region.

Environmental services can be partially operated online from Australia. You should capitalise on the technology available but you would need to check that your trading partner in Thailand has the equivalent facilities to support the transaction of services.

Electronic signature and online money transfer are not yet available in the system. Although, it is viable to make a payment from a credit card in Thailand to an Australian account.

Transport

Most environmental technology equipment is shipped by sea freight:

* Shipping time from Australia to Thailand takes two weeks

* Shipping frequencies are twice weekly from major Australian ports such as in Melbourne

It is recommended that you use a customs broker or agent to clear the goods from customs. Your local agent or distributor usually handles the import procedures and documentation. It is a requirement that a Thai registered company complete all import procedures.

It is advisable to investigate a variety of service providers.

Payment is usually by irrevocable letter of credit.

Links and industry contacts

Environment-related resources

Pollution Control Department, Ministry of Natural Resources and Environment – www.pcd.go.th

Office of Environmental Policy and Planning, Ministry of Natural Resources and Environment – www.oepp.go.th

Department of Industrial Works, Ministry of Industry – www.diw.go.th

Bangkok Metropolitan Administration – www.bma.go.th

Public Works Department, Ministry of Interior – www.pwd.go.th

Wastewater Management Authority – www.wma.or.th/webdoc/index.html

Provincial Waterworks Authority – www.pwa.co.th/english/index.html

Metropolitan Waterworks Authority – www.mwa.or.th

The Industrial Estates Authority of Thailand – www.ieat.go.th

Petroleum Authority of Thailand – www.pttplc.com/en/default.asp

Government, business and trade resources for Thailand

Ministry of Commerce – www.moc.go.th

Ministry of Foreign Affairs – www.mfa.go.th

Royal Thai Customs Department – www.customs.go.th

Stock Exchange of Thailand – www.set.or.th/en/index.html

Thai Chamber of Commerce – www.tcc.or.th

Thailand Board of Investment – www.boi.go.th

Tourism Authority of Thailand – www.tourismthailand.org

World Trade Organization – www.wto.org

Yellow Pages – www.yellowpages.co.th

Media

The Bangkok Post – www.bangkokpost.com

The Nation – www.nationmultimedia.com

Thailand.com – www.thailand.com

Bangkok.com – www.bangkok.com

Australian resources

Australian Embassy Bangkok – www.austembassy.or.th

Australian-Thai Chamber of Commerce – www.austchamthailand.com

Service providers

Qantas freight – www.qantas.com.au/freight/dyn/menu

British Airways Air Cargo – www.baworldcargo.com

Airports of Thailand PLC – www.airportthai.co.th

Thai Airways International – www.thaiairways.com

Thai International Freight Forwarders Association

Email:

This e-mail address is being protected from spambots. You need JavaScript enabled to view it

back to top of siteback to top

Contact details

The Australian Trade Commission (Austrade) is the Australian Government’s trade and investment development agency, operating as a statutory agency within the Foreign Affairs and Trade portfolio.

Austrade assists Australian businesses contribute to national prosperity by succeeding in trade and investment, internationally, and promoting and supporting productive foreign investment into Australia.

Austrade:

* Delivers services that assist Australian businesses initiate, sustain and grow trade and outward investment.

* Promotes Australia as an inward investment destination and, with the States and Territories, supports the inflow of productive foreign direct investment.

* Administers the Export Market Development Grants scheme.

* Undertakes initiatives designed to improve community awareness of, and commitment to, international trade and investment.

* Provides advice to the Australian Government on its trade and investment development activities.

* Delivers consular, passport and other government services in designated overseas locations.

A list of Austrade offices (in alphabetical order of country) is available.

More information

For further information please contact Austrade on 13 28 78 or email

This e-mail address is being protected from spambots. You need JavaScript enabled to view it

Submitted by Singapore

AIM

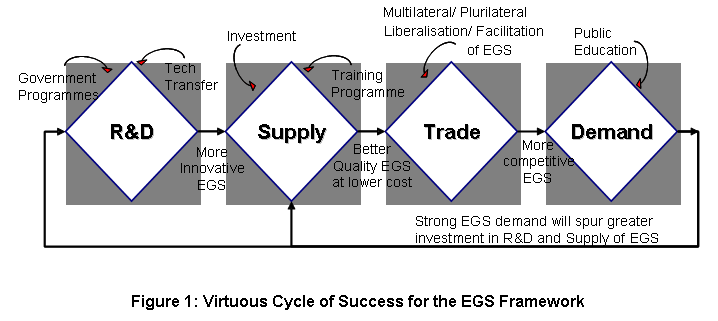

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...