| The Little Drop That Could |

|

| Thursday, April 30, 2009 |

Yes the solar energy industry grew 38% in 2007 and represented $23.1 billion in global revenues, up from $5.5 billion in 2002, but solar power still represents only 0.1% of global electricity generation. And yes, the stock value of solar energy companies rose 210% in 2007 and venture investing in the sector grew 200% in 2007, but solar power still represents only 0.1% of global electricity generation. And yes, solar photovoltaics now represent 3.3% of electricity generation capacity in Germany thanks to a well-structured feed-in tariff system, but solar power still represents only 0.1% of global electricity generation. And yes, solar energy of all types is expected to double again in capacity in three years, but solar energy by most accounts still will represent only 0.2% of global energy consumption in 2010. For every argument in its favor, the relative insignificance of solar energy in the global energy equation waits to trump every card in the hand of solar advocates. Solar energy is indeed a mere drop in the bucket of mankind’s 500 quadrillion BTUs of annual global energy usage. But just as surely as the sun comes up in the morning, that drop keeps getting bigger and less insignificant. But a drop it still is, and a number of factors are required for the drop to become even a trickle against the fire hose of global oil production of 90 million barrels a day. Due to its intermittency and site dependency, advances in solar technology, as well as energy storage, efficient transmission and dispatchable applications like plug-in hybrid vehicles for PVs, must be made for solar energy even to conceive of a level of 10% of electricity in our lifetime. Many solar companies do not believe that 10% is an unrealistic goal. Climate Change Business Journal’s 2008 survey of 61 solar energy companies performed in March 2008 resulted in a median response that all types of solar energy will account for 5% of U.S. electricity generation in 2020, and 15% in 2050. Expectations for Europe were similar with a median response of 5-6% for 2020 and also 15% for 2020. For China and much of the developing world the expectation is 3-4% in 2020, and 8-10% in 2050. Solar companies are understandably bullish on the prospects for their industry, and likewise are their marketmakers. Equity analyst Pavel Molchanov of Raymond James theorizes that PV’s share of 3.3% of power generation capacity in Germany is a realistic goal across the OECD by 2020 and equates this to an annualized growth rate of 20%. Feed-in tariffs and similar instruments are key for now for their economic incentive, but grid parity is only a matter of time, says Molchanov, and likely it will be attained by 2015, or even earlier with higher power prices. For sustained near-term growth in the 30-40% range, however, consistent solar market drivers of energy security, financial incentives, minimum renewable requirements, lowered costs from technology development and manufacturing scale, high costs of oil & gas, and climate change policy all must be maintained or enhanced--along with some measure of economic stability. A balance of short- and long-term policy instruments incorporating all these factors hardly seems far-fetched. At this point, most U.S. solar companies view climate change drivers as having little impact on driving solar growth in the short term, with European solar firms more inclined to see themselves as part of a broader climate change industry. So how does the $23-billion solar industry fit in the context of the $300-billion global climate change industry? First it is neither the largest nor fastest growing segment, but clearly it intersects or even competes with a number of segments and subcategories like other renewables and low-carbon sources of power. Solar’s prospects will also be impacted by developments in carbon capture & storage, energy storage, energy efficiency, green buildings and carbon trading. (See www.climatechangebusiness.com for CCBJ’s detailed segmentation of the climate change industry.) The future for solar energy is indeed bright and CCBJ forecasts growth in each of our six subcategories. Overall growth is forecast at 20-30% from 2008-2011 and 15-20% from 2012-2014. CCBJ is by no means the first to attempt to quantify and forecast the solar energy industry, but few before have approached the matter in dollars, incorporating the element of price, and taken on the value of the power generated. As PV and other solar data shows, the difference between capacity and power generated is substantial and always will be. Sales of all solar systems & equipment, including integration & installation equipment and services, accounted for 72% of the $23-billion global solar energy industry (see table below). The value of power generated by solar energy worldwide in 2007 is estimated by CCBJ at $6.6 billion or 28% of the industry. At $13.4 billion, PV represented the dominant share of systems & equipment sales. Power sales will grow from 28% to 42% of the $79-billion solar industy in 2014 (see chart above), although fluctuating economic conditions will impact this scenario. One thing is sure, however. Solar energy’s drop-in-the-bucket days are over and the persistent effort of companies, investors, policymakers and other advocates will be rewarded with a promising future. The Global Solar Energy Industry ($bil)

Source: Climate Change Business Journal, EBI Inc. estimates derived from a variety of sources |

Submitted by Singapore

AIM

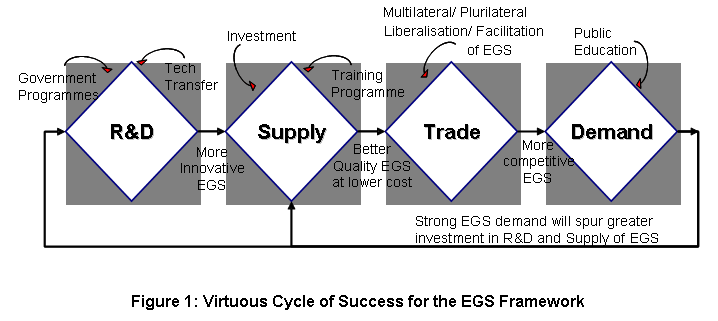

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...