| An Examination of Trade in Environmentally Preferable Goods and Services in the NAFTA Region |

|

| Thursday, April 30, 2009 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Commission for Environmental Cooperation (CEC) conducts policy and research work on environmentally preferable goods and services (EPGS) in eleven different activities. One specific activity is to “Identify changes/trends in trade in green goods and services in the NAFTA region.” Lacking any definitive quantification of trade in EPGS, and also lacking any established or consistently used industry codes that result in ongoing government statistics on environmental trade, in 2003 CEC commissioned a study to provide a definition and quantification of trade in EPGS in the NAFTA region. CEC selected Environmental Business International Inc. (EBI), a market research firm dedicated to the environmental industry since 1988, to conduct this research and present a quantification of environmental trade in the NAFTA region.

An Examination of Trade in Environmentally Preferable Goods and Services in the NAFTA Region Spring 2004 Commissioned by and conducted on behalf of: Chantal Line Carpentier, Ph.D. Head, Environment, Economy, and Trade Program Commission for Environmental Cooperation Researched and written by: Grant Ferrier President, Environmental Business International, Inc.

IntroductionThe Commission for Environmental Cooperation (CEC) conducts policy and research work on environmentally preferable goods and services (EPGS) in eleven different activities. One specific activity is to “Identify changes/trends in trade in green goods and services in the NAFTA region.” Lacking any definitive quantification of trade in EPGS, and also lacking any established or consistently used industry codes that result in ongoing government statistics on environmental trade, in 2003 CEC commissioned a study to provide a definition and quantification of trade in EPGS in the NAFTA region. CEC selected Environmental Business International Inc. (EBI), a market research firm dedicated to the environmental industry since 1988, to conduct this research and present a quantification of environmental trade in the NAFTA region. Industry DefinitionTo quantify trade in environmental good and services, a consensus on industry definition must first be established. An objective of the definition was consistency and comparability with historical statistics on the environmental industry, with definitions used for international environmental trade and policy discussions with WTO, OECD, UNCTAD and other international bodies. In addition the definition was desired to be consistent with how the industry views itself and to maximize the level of accuracy to be obtained in such an ambitious research task as quantifying environmental trade in absence of consistent codes used in other more established industry sectors. Discussions were held to determine the parameters of environmental industry definition with EBI and CEC encompassing the existing research and multiple contacts each party has had in its respective history in environmentally preferable goods and services. As a result of these discussions, the following definition was used (Note: More detail on these segments and examples of clients is presented in the appendix of this report): SERVICES Analytical Services Wastewater Treatment Works Solid Waste Management Hazardous Waste Management Remediation/Industrial Services Consulting & Engineering EQUIPMENT Water Equipment and Chemicals Instruments & Information Systems Air Pollution Control Equipment Waste Management Equipment Process & Prevention Technology RESOURCES Water Utilities Resource Recovery Clean Energy Systems & Power CONSUMER GOODS & SERVICES Sustainable Agriculture Sustainable Forestry Eco-tourism Research MethodologyTo obtain industry size, market size and import/export estimates on each NAFTA country, considerable weight was placed on annual surveys of environmental product and service firms conducted by EBI. Secondary research conducted by EBI to assess government business and trade statistics in the United States, Canada and Mexico in addition to research conducted by private companies, investors and academic and non-profit institutions were also used to build quantification and export/import models in each segment of the environmental industry. A partial list of documents referenced is available at the end of this report. Of particular note is research performed by Statistics Canada in surveying Canadian environmental product and service firms, research on such a scale that is not performed by the governments of the other two NAFTA nations. To obtain industry segment sizes, the basic methodology is to create an ‘industry segment universe’ table that classifies all industry segment participants into one of several revenue size categories (e.g. $10-20 million in annual revenues) for that segment. An accurate database of companies in that segment built from industry directories, association memberships, professional certification societies and other sources is first required. Surveys of these companies are then conducted by telephone, fax, email and on the internet to obtain year-by-year revenue information, in addition to export sales, regional distribution of exports (both of which have pertinence to this project) and a number of other statistics such as product sales breakdowns, customer type breakdowns, growth forecasts, etc. Survey data is then compiled into a database or spreadsheet and then data is extrapolated for the ‘missing’ companies from the response set in statistically acceptable methods for each size category. This ‘sell-side’ research has been the basis of EBI’s annual quantification of the The addition of three ‘Consumer Goods’ segments to the analysis for this report provided an additional challenge for EBI as these areas have not been carefully researched by EBI on an annual basis. In each of these segments secondary research was sought, but in only the sustainable agriculture segment where considerable statistics on organic foods are becoming available was anything available with some statistical merit. In each of the other two segments, efforts were made to identify companies selling sustainable forestry products or eco-tourism services and to build sell-side models with existing data. Data HighlightsEnvironmental market sizes · The global environmental market was $548 billion in 2001. · The · The Canadian environmental market was $16.1 billion in 2001. · The Mexican environmental market was $3.8 billion in 2001. · The NAFTA-region environmental market was $232 billion in 2001 or 41% of the global total. Intra-NAFTA Environmental Trade Statistics · Total Environmental Trade within the NAFTA region totaled $4.1 billion in 2001. · Canada-Mexico Environmental Trade totaled $32 million in 2001, $18.9 million in Canadian exports to · Canada-US Environmental Trade totaled $3.0 billion in 2001, $1.2 billion in Canadian exports to the · Mexico-US Environmental Trade totaled $1.0 billion in 2001, $116 million in Mexican exports to the Inter-NAFTA Environmental Trade Statistics · Total Environmental exports from the NAFTA region to the rest of the world totaled $17.6 billion in 2001. · Total Environmental imports in the NAFTA region from the rest of the world totaled $16.7 billion in 2001, resulting in a trade surplus for the NAFTA region of $920 million. · Equipment segments accounted for two-thirds of environmental trade in the NAFTA region in 2001. · Within equipment, water equipment & chemicals, air pollution control and waste management equipment were the largest segments in environmental trade Emerging trends and potential for further trade· Whereas equipment segments represent the vast majority of environmental trade, the largest growth is occurring in segments related to clean energy and sustainable consumer goods. · Service and resource segments related to waste and water infrastructure together represent the majority of global markets, but NAFTA nations are not global players in these markets. The following table summarizes environmental trade trends in each segment:

Environmental Trade Data Tables(All figures in $ a)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

(or |

(or |

|

Equipment |

|

|

|

Water Equipment & Chemicals |

4.44 |

0.09 |

|

Air Pollution Control |

4.47 |

0.13 |

|

Instruments & Info. Systems |

0.16 |

0.00 |

|

Waste Mgmt Equipment |

4.26 |

1.62 |

|

Process & Prevention Tech. |

0.02 |

0.02 |

|

Services |

|

|

|

Solid Waste Management |

0.59 |

0.00 |

|

Hazardous Waste Mgmt |

0.13 |

0.00 |

|

Consulting & Engineering |

0.59 |

0.05 |

|

Remediation/Industrial Svcs. |

0.90 |

0.34 |

|

Analytical Services |

0.19 |

0.00 |

|

Water Treatment Works |

0.08 |

0.00 |

|

Resources |

|

|

|

Water Utilities |

0.07 |

0.00 |

|

Resource Recovery |

1.15 |

0.07 |

|

Clean Energy Systems & Power |

0.29 |

0.01 |

|

Sustainable Agriculture |

1.26 |

4.45 |

|

Sustainable Forestry |

0.00 |

0.70 |

|

Eco-Tourism |

0.33 |

5.36 |

|

Total |

18.93 |

12.84 |

Canada-US Environmental Trade ($U.S.

|

|

(or |

(or |

|

Equipment |

|

|

|

Water Equipment & Chemicals |

314.5 |

848.9 |

|

Air Pollution Control |

316.8 |

169.6 |

|

Instruments & Info. Systems |

18.1 |

69.9 |

|

Waste Mgmt Equipment |

301.9 |

155.4 |

|

Process & Prevention Tech. |

2.0 |

6.3 |

|

Services |

|

|

|

Solid Waste Management |

14.4 |

71.4 |

|

Hazardous Waste Mgmt |

3.1 |

13.3 |

|

Consulting & Engineering |

60.4 |

251.9 |

|

Remediation/Industrial Svcs. |

22.1 |

15.8 |

|

Analytical Services |

9.1 |

2.4 |

|

Water Treatment Works |

7.8 |

9.4 |

|

Resources |

|

|

|

Water Utilities |

7.4 |

8.7 |

|

Resource Recovery |

11.5 |

79.7 |

|

Clean Energy Systems & Power |

29.5 |

10.3 |

|

Sustainable Agriculture |

69.3 |

86.2 |

|

Sustainable Forestry |

9.6 |

3.6 |

|

Eco-Tourism |

16.5 |

2.9 |

|

Total |

1213.9 |

1805.6 |

Mexico-US Environmental Trade ($U.S.

|

|

|

|

|

Equipment |

|

|

|

Water Equipment & Chemicals |

1.3 |

300.5 |

|

Air Pollution Control |

1.3 |

98.4 |

|

Instruments & Info. Systems |

0.0 |

35.0 |

|

Waste Mgmt Equipment |

10.5 |

62.1 |

|

Process & Prevention Tech. |

0.2 |

3.2 |

|

Services |

|

|

|

Solid Waste Management |

3.3 |

40.8 |

|

Hazardous Waste Mgmt |

0.4 |

31.8 |

|

Consulting & Engineering |

0.5 |

58.7 |

|

Remediation/Industrial Svcs. |

0.7 |

23.8 |

|

Analytical Services |

0.0 |

3.7 |

|

Water Treatment Works |

5.4 |

46.9 |

|

Resources |

|

|

|

Water Utilities |

0.3 |

26.1 |

|

Resource Recovery |

0.3 |

142.2 |

|

Clean Energy Systems & Power |

1.1 |

41.1 |

|

Sustainable Agriculture |

32.1 |

4.3 |

|

Sustainable Forestry |

5.6 |

0.0 |

|

Eco-Tourism |

53.6 |

0.1 |

|

Total |

116.6 |

918.7 |

Total Environmental Trade in the NAFTA region (sum of 3 groups bi-lateral groups, exports and imports)

|

|

Total Trade Value |

Percent of Environmental Trade |

|

Equipment |

|

67% |

|

Water Equipment & Chemicals |

1,469.8 |

|

|

Air Pollution Control |

590.7 |

|

|

Instruments & Info. Systems |

123.2 |

|

|

Waste Mgmt Equipment |

535.8 |

|

|

Process & Prevention Tech. |

11.7 |

|

|

Services |

|

17% |

|

Solid Waste Management |

130.6 |

|

|

Hazardous Waste Mgmt |

48.7 |

|

|

Consulting & Engineering |

372.1 |

|

|

Remediation/Industrial Svcs. |

63.6 |

|

|

Analytical Services |

15.4 |

|

|

Water Treatment Works |

69.5 |

|

|

Resources |

|

16% |

|

Water Utilities |

42.5 |

|

|

Resource Recovery |

235.0 |

|

|

Clean Energy Systems & Power |

82.2 |

|

|

Sustainable Agriculture |

197.6 |

|

|

Sustainable Forestry |

19.5 |

|

|

Eco-Tourism |

78.8 |

|

|

Total |

4,086.6 |

|

Environmental Trade between the NAFTA region and Latin America and the Rest of the World

Canada-LatAm and ROW Environmental Trade ($mil US

|

|

|

|

|

Equipment |

|

|

|

Water Equipment & Chemicals |

8.5 |

49.0 |

|

Air Pollution Control |

8.6 |

49.3 |

|

Instruments & Info. Systems |

0.5 |

7.6 |

|

Waste Mgmt Equipment |

8.2 |

47.0 |

|

Process & Prevention Tech. |

0.1 |

0.8 |

|

Services |

|

|

|

Solid Waste Management |

1.2 |

3.9 |

|

Hazardous Waste Mgmt |

0.3 |

0.8 |

|

Consulting & Engineering |

42.7 |

80.6 |

|

Remediation/Industrial Svcs. |

1.8 |

6.0 |

|

Analytical Services |

0.2 |

1.2 |

|

Water Treatment Works |

5.5 |

10.4 |

|

Resources |

|

|

|

Water Utilities |

5.2 |

9.9 |

|

Resource Recovery |

1.2 |

101.6 |

|

Clean Energy Systems & Power |

20.8 |

39.3 |

|

Sustainable Agriculture |

2.5 |

52.9 |

|

Sustainable Forestry |

0.0 |

70.4 |

|

Eco-Tourism |

0.3 |

15.8 |

|

Total |

107.5 |

546.5 |

Mexico-LatAm and ROW Environmental Trade ($mil US

|

|

|

|

|

Equipment |

|

|

|

Water Equipment & Chemicals |

0.2 |

0.2 |

|

Air Pollution Control |

1.0 |

0.1 |

|

Instruments & Info. Systems |

0.0 |

0.0 |

|

Waste Mgmt Equipment |

3.2 |

0.8 |

|

Process & Prevention Tech. |

0.0 |

0.0 |

|

Services |

|

|

|

Solid Waste Management |

0.4 |

0.0 |

|

Hazardous Waste Mgmt |

0.0 |

0.0 |

|

Consulting & Engineering |

1.7 |

0.2 |

|

Remediation/Industrial Svcs. |

5.5 |

0.3 |

|

Analytical Services |

0.3 |

0.1 |

|

Water Treatment Works |

3.6 |

0.0 |

|

Resources |

|

|

|

Water Utilities |

4.9 |

0.0 |

|

Resource Recovery |

0.4 |

0.6 |

|

Clean Energy Systems & Power |

0.3 |

0.1 |

|

Sustainable Agriculture |

1.0 |

11.9 |

|

Sustainable Forestry |

0.0 |

0.7 |

|

Eco-Tourism |

3.2 |

45.0 |

|

Total |

25.8 |

60.0 |

USA-LatAm and ROW Environmental Trade ($mil US

|

|

|

|

|

Equipment |

|

|

|

Water Equipment & Chemicals |

292.1 |

4,901.4 |

|

Air Pollution Control |

303.9 |

2,077.0 |

|

Instruments & Info. Systems |

69.9 |

1,573.2 |

|

Waste Mgmt Equipment |

93.2 |

1,242.9 |

|

Process & Prevention Tech. |

3.2 |

50.4 |

|

Services |

|

|

|

Solid Waste Management |

30.6 |

61.2 |

|

Hazardous Waste Mgmt |

5.3 |

2.7 |

|

Consulting & Engineering |

169.6 |

1,674.4 |

|

Remediation/Industrial Svcs. |

27.7 |

328.8 |

|

Analytical Services |

5.8 |

47.0 |

|

Water Treatment Works |

56.3 |

75.0 |

|

Resources |

|

|

|

Water Utilities |

26.1 |

26.1 |

|

Resource Recovery |

79.7 |

2,285.0 |

|

Clean Energy Systems & Power |

61.6 |

913.8 |

|

Sustainable Agriculture |

12.9 |

327.4 |

|

Sustainable Forestry |

0.0 |

8.4 |

|

Eco-Tourism |

0.3 |

25.5 |

|

Total |

1,238.2 |

15,620.1 |

NAFTA region-LatAm and ROW Environmental Trade ($mil US

|

|

NAFTA Exports to LatAM |

NAFTA Exports to ROW |

|

Equipment |

|

|

|

Water Equipment & Chemicals |

300.8 |

4,950.6 |

|

Air Pollution Control |

313.5 |

2,126.4 |

|

Instruments & Info. Systems |

70.4 |

1,580.8 |

|

Waste Mgmt Equipment |

104.6 |

1,290.7 |

|

Process & Prevention Tech. |

3.2 |

51.3 |

|

Services |

|

|

|

Solid Waste Management |

32.2 |

65.1 |

|

Hazardous Waste Mgmt |

5.6 |

3.5 |

|

Consulting & Engineering |

213.9 |

1,755.2 |

|

Remediation/Industrial Svcs. |

35.0 |

335.1 |

|

Analytical Services |

6.4 |

48.3 |

|

Water Treatment Works |

65.3 |

85.4 |

|

Resources |

|

|

|

Water Utilities |

36.2 |

35.9 |

|

Resource Recovery |

81.3 |

2,387.2 |

|

Clean Energy Systems & Power |

82.7 |

953.2 |

|

Sustainable Agriculture |

16.4 |

392.2 |

|

Sustainable Forestry |

0.0 |

79.5 |

|

Eco-Tourism |

3.8 |

86.4 |

|

Total |

1,371.4 |

16,226.7 |

d) Total Environmental Trade between the NAFTA region and the Rest of the World (ROW; $mil US

|

|

NAFTA Exports to ROW |

NAFTA Imports from ROW |

Trade Balance |

Total Imports into NAFTA Countries |

Imports into NAFTA Countries from other NAFTA countries |

|

Equipment |

10,792.4 |

6,295.1 |

4,497.3 |

9,026.2 |

2,731.1 |

|

Water Equipment & Chemicals |

5,251.3 |

2,210.4 |

3,040.9 |

3,680.2 |

1,469.8 |

|

Air Pollution Control |

2,440.0 |

2,371.2 |

68.7 |

2,961.9 |

590.7 |

|

Instruments & Info. Systems |

1,651.2 |

350.6 |

1,300.6 |

473.8 |

123.2 |

|

Waste Mgmt Equipment |

1,395.3 |

1,220.8 |

174.5 |

1,756.6 |

535.8 |

|

Process & Prevention Tech. |

54.5 |

142.0 |

-87.5 |

153.7 |

11.7 |

|

Services |

2,650.9 |

5,388.3 |

-2,737.4 |

6,088.3 |

700.0 |

|

Solid Waste Management |

97.3 |

1,349.0 |

-1,251.7 |

1,479.6 |

130.6 |

|

Hazardous Waste Mgmt |

9.1 |

214.9 |

-205.8 |

263.6 |

48.7 |

|

Consulting & Engineering |

1,969.1 |

683.5 |

1,285.6 |

1,055.7 |

372.1 |

|

Remediation/Industrial Svcs. |

370.1 |

471.0 |

-100.9 |

534.6 |

63.6 |

|

Analytical Services |

54.6 |

2.0 |

52.6 |

17.4 |

15.4 |

|

Water Treatment Works |

150.7 |

2,667.9 |

-2,517.2 |

2,737.4 |

69.5 |

|

Resources |

4,154.9 |

5,019.2 |

-864.3 |

5,674.7 |

655.5 |

|

Water Utilities |

72.1 |

2,331.3 |

-2,259.2 |

2,373.8 |

42.5 |

|

Resource Recovery |

2,468.5 |

320.0 |

2,148.5 |

555.0 |

235.0 |

|

Clean Energy Systems & Power |

1,035.9 |

1,524.2 |

-488.3 |

1,606.4 |

82.2 |

|

Sustainable Agriculture |

408.6 |

610.4 |

-201.8 |

808.0 |

197.6 |

|

Sustainable Forestry |

79.5 |

41.5 |

38.0 |

61.0 |

19.5 |

|

Eco-Tourism |

90.2 |

191.7 |

-101.5 |

270.5 |

78.8 |

|

Total |

17,598.1 |

16,702.6 |

895.5 |

20,789.2 |

4,086.6 |

The Global Environmental Market ($mil US

|

By Region |

2001 |

% of Total |

|

|

211.2 |

38.5% |

|

|

160.8 |

29.3% |

|

|

93.3 |

17.0% |

|

Rest of |

25.6 |

4.7% |

|

|

3.6 |

0.7% |

|

Rest of |

9.2 |

1.7% |

|

|

15.2 |

2.8% |

|

Australia/NZ |

8.6 |

1.6% |

|

Central & Eastern Europe |

10.2 |

1.9% |

|

|

7.0 |

1.3% |

|

|

3.6 |

0.7% |

|

Total |

548 |

100% |

The 2001 Global Environmental Market ($mil US

|

|

Global |

|

|

|

|

|

|

|

Equipment |

|

|

|

|

|

|

|

|

Water Equipment & Chemicals |

43.0 |

17.1 |

1.72 |

0.40 |

39.8% |

4.0% |

0.9% |

|

Air Pollution Control |

34.0 |

18.2 |

0.86 |

0.14 |

53.5% |

2.5% |

0.4% |

|

Instruments & Info Systems |

6.6 |

2.4 |

0.13 |

0.08 |

36.5% |

1.9% |

1.2% |

|

Waste Mgmt Equipment |

32.6 |

9.5 |

0.88 |

0.23 |

29.0% |

2.7% |

0.7% |

|

Process & Prevention Tech |

3.0 |

1.4 |

0.06 |

0.04 |

46.8% |

2.0% |

1.2% |

|

Services |

|

|

|

|

|

|

|

|

Solid Waste Management |

120.7 |

41.9 |

2.93 |

0.46 |

34.7% |

2.4% |

0.4% |

|

Haz Waste Management |

17.8 |

5.0 |

0.44 |

0.08 |

28.2% |

2.5% |

0.4% |

|

Consulting & Engineering |

31.5 |

16.6 |

1.33 |

0.11 |

52.9% |

4.2% |

0.4% |

|

Remediation/Ind'l Services |

29.4 |

11.1 |

1.05 |

0.30 |

37.8% |

3.6% |

1.0% |

|

Analytical Services |

3.8 |

1.3 |

0.13 |

0.03 |

32.8% |

3.3% |

0.8% |

|

Water Treatment Works |

78.6 |

31.6 |

2.37 |

0.65 |

40.2% |

3.0% |

0.8% |

|

Resources |

|

|

|

|

|

|

|

|

Water Utilities |

87.0 |

33.7 |

2.25 |

0.76 |

38.7% |

2.6% |

0.9% |

|

Resource Recovery |

35.7 |

10.5 |

0.75 |

0.22 |

29.5% |

2.1% |

0.6% |

|

Clean Energy Systems & Power |

23.9 |

10.8 |

0.33 |

0.11 |

45.4% |

1.4% |

0.5% |

|

Total |

548 |

211.2 |

15.2 |

3.6 |

38.6% |

2.8% |

0.7% |

*Does not include consumer goods segments

Key References

Comisión Mexicana de Infraestructura Ambienal (COMIA), Informe para la Séptima Reunión Plenaria, 2002, publicada www.semarnat.gob.mx.

Comisión Nacional del Agua (CNA), Situación del subsector agua potable, alcantarillado y saneamiento a diciembre de 2001, México, s/f.

Data & Statistics. World Bank.

Ecotourism: Setting Standards; Environment, July August 2003

Environmental Business International Inc., various documents, research reports, survey databases and editions of Environmental Business Journal.

Institute for Sustainable Forestry, <www.isf-sw.org>

Instituto Nacional de Ecología (INE), Áreas de Oportunidad en el Sector Ambiental de la Economía, México, 1997.

The International Ecotourism Society,

Market Research Library.

Penton Media Inc, Nutrition Business Journal, NBJ’s Organic Foods Report 2003

Procuraduría Federal de Protección al Ambiente (PROFEPA), Informe Anual 2002, México

Secretaría de Medio Ambiente y Recursos Naturales (SEMARNAT), Programa Nacional de Medio Ambiente y Recursos Naturales 2001-2006, México, 2001.

Statistics

Statistics

Sustainable Forestry Initiative,

Trade Statistics for Environmental Products.

U.S. International Trade Statistics: Value of Exports, General Imports, and Imports by Country by 3-digit Commodity Groupings,

Environmental Industry Segments

|

Segment |

Description |

Examples of Clients |

|

Environmental Services (Environmentally Preferable Services) |

||

|

Environmental Testing & Analytical Services |

Provide testing of “environmental samples” (soil, water, air and some biological tissues) |

Regulated industries, Gov’t, C&E, Hazardous waste and remediation contractors |

|

Wastewater Treatment Works |

Collection and treatment of residential, commercial and industrial wastewaters. Facilities are commonly know as POTWs or publicly owned treatment works. |

Municipalities, Commercial Establishments & All industries |

|

Solid Waste Management |

Collection, processing and disposal of solid waste |

Municipalities & All industries |

|

Hazardous Waste Management |

Collection, processing and disposal of hazardous, medical waste, nuclear waste |

Chemical, Petroleum, Mfgrs Government agencies |

|

Remediation/Industrial Services |

Cleanup of contaminated sites, buildings and environmental cleaning of operating facilities |

Government agencies Property owners Industry |

|

Environmental Consulting & Engineering (C&E) |

Engineering, consulting, design, assessment, permitting, project management, O&M, monitoring, etc. |

Industry, Government Municipalities, Waste Mgmt. companies, POTWs |

|

Environmental Equipment (Environmentally Preferable Goods) |

||

|

Water Equipment & Chemicals |

Provide equipment, supplies and maintenance in the delivery and treatment of water and wastewater. |

Municipalities & All industries |

|

Instruments & Information Systems |

Produce instrumentation for the analysis of environmental samples. Includes info systems and software. |

Analytical services, Gov’t Regulated companies |

|

Air Pollution Control Equipment |

Produce equipment and tech. to control air pollution. Includes vehicle controls. |

Utilities, Waste-to-energy Industries, Auto industry |

|

Waste Management Equipment |

Equipment for handling, storing or transporting solid, liquid or haz waste. Includes recycling/remediation equipment. |

Municipalities Generating industries Solid waste companies |

|

Process & Prevention Technology |

Technology for in-process pollution prevention and waste recovery |

All industries |

|

Environmental Resources |

||

|

Water Utilities |

Selling water to end users |

Consumers, Municipalities & All industries |

|

Resource Recovery |

Selling materials recovered and converted from industrial by-products or post-consumer waste |

Municipalities Generating industries Solid waste companies |

|

Clean Energy Power & Systems |

Selling power and systems in solar, wind, geothermal, small scale hydro, energy efficiency and DSM |

Utilities All industries and consumers |

|

Environmental Consumer Goods (Environmentally Preferable Products or EPPs) |

||

|

Sustainable Agriculture Products |

Agricultural products or finished food products derived from certified organic materials and processes. |

Consumers, Food manufacturing companies, Food service companies |

|

Sustainable Forestry Products |

Timber or finished forest products derived from certified sustainable forestry programs. |

Consumers Manufacturers |

|

Eco-Tourism |

Tourism revenues derived from certified eco-tourism locations that minimize ‘environmental footprint’ in transportation and lodging facilities |

Consumers |

Submitted by Singapore

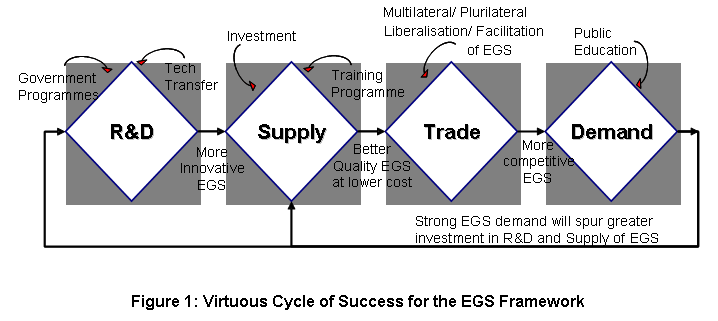

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...