Environmental Technology In Singapore

1.0 MARKET STRUCTURE

1.1 Background

In 1968 Singapore introduced the concept of a "clean and green garden city." Since then the

Ministry of the Environment has carefully monitored the environmental impact of urban

growth and industrialisation.

The government is a key driver for change in Singapore and in 1992 introduced the

“Singapore Green Plan 2002.” This plan outlined the steps required for cleaner air, water

and land in Singapore. A draft plan of SGP 2012 was released in November 2001 with an

emphasis on environmental sustainability. SGP 2012 focuses on areas including optimizing

resources through recycling and conservation, minimizing environmental impact through

creative use of technology, and the sharing of ideas with countries in the region.

Over the past three decades, Singapore has transformed from a labour driven economy to

an advanced high-tech country. Driven by the “Greener Singapore” policies, upgrading

chemicals, electronics and petrochemicals plants are a requirement in order to meet

environmental standards.

The Prime Minister of Singapore has urged the private sectors of Singapore and a handful of

European nations to work together on developing environmental technology. As a

consequence, a number of joint-ventures have formed between local companies, such as

SembCorp Engineering, and leading waste management firms including Sita from France.

1.2 Market Size

Singapore has accumulated considerable experience and know-how in environmental

management, protection and infrastructure. Specific skills in environmental planning and

development, environmental skills in environmental planning and development,

environmental public health, operation and maintenance of environmental facilities and

legislation were developed. Capabilities such as engineering construction, procurement,

mechanical equipment control and maintenance, water and wastewater treatment, pollution

control measurement and control technology, instrumentation, laboratories and consultancy

services have also been built up.

Singapore is also building up its capabilities in research and development in environmental

technology. An Environmental Technology in Institute was set up in 1996 to spearhead the

R&D in ET in Singapore. There are more than 100 ET companies in Singapore comprising

mainly small local companies and a few major engineering companies which are public listed

companies Companies in the engineering services, wastewater and waste treatment

dominate the environmental technology industry. Some of these companies have been very

successful in establishing a niche in the regional market.

1.3 Growth Rate

Government policies and national legislation are the main drivers for the growth of

environmental market. In order to sustain the engineering sector's growth, the Singapore’s

Economic Development Board (EDB) is promoting four new industries, one of them being

Environmental Technology.

No data is available for the market growth rate within Singapore but the global growth rate is

estimated to be between 15% and 30%.

1.4 Known Factors Influencing Growth Rate

Singapore is developing itself as a hub for environmental technology and infrastructure. The

drive to become a recognised hub is being lead by the Government who recognises the

economic and social value of such an endeavour.

The significant electronics and chemical clusters in Singapore require large quantities of

water. As water is a scarce and precious resource in Singapore, these industries have use

industrial water as much as possible for their supporting activities such as cooling towers,

and component washing. Environmental technology companies which are involved in the

manufacturing of high value-added treatment facilities and media, such as membranes, and

water treatment chemicals, are expected to be sought after.

The rapid urbanisation in the region and rising demand for consumer goods is leading to a

vast market for municipal solid waste collection, disposal services and facilities. Singapore is

producing three times more waste than it was 20 years ago, and pressure is mounting on the

solid waste collection facilities.

Incineration disposes of almost 90% of the solid waste produced in Singapore. The resulting

ash is typically used for landfill, however Singapore is now investigating converting the ash

into roading materials as is done in several European countries.

The Environmental Technology Institute of Singapore is also using marine-clay unearthed

from the North-East MRT line's (underground subway) construction to transform it to building

materials.

3

Singapore’s Nanyang Technological University (NTU) recently joined an alliance of 5 of

Asia’s top universities to research environmental technologies.

2.0 ENVIRONMENTAL OVERVIEW

Minister of the Environment Associate Professor Yaacob Ibrahim

Total Energy Consumption (1999E) 1.4 quadrillion Btu* (0.4% of world total

energy consumption)

Energy-Related Carbon Emissions (1999E) 25.5 million metric tons of carbon (0.4% of

world carbon emissions)

Per Capita Energy Consumption (1999E) 341.7 million Btu (vs. U.S. value of 355.8

million Btu)

Per Capita Carbon Emissions (1999E) 6.4 metric tons of carbon (vs. U.S. value of

5.5 metric tons of carbon)

Energy Intensity (1999E) 19,455 Btu/$1990 (vs U.S. value of 12,638

Btu/$1990)**

Carbon Intensity (1999E) 0.36 metric tons of carbon/thousand $1990

(vs U.S. value of 0.19 metric tons/thousand

$1990)**

Sectoral Share of Energy Consumption

(1998E)

Transportation (61.2%), Industrial (30.8%),

Commercial (4.8%), Residential (3.2%)

Sectoral Share of Carbon Emissions (1998E) Industrial (58.3%), Transportation (26.5%),

Commercial (9.1%), Residential (6.1%)

Fuel Share of Energy Consumption (1999E) Oil (95.9%), Natural Gas (4.1%), Coal

(0.0%)

Fuel Share of Carbon Emissions (1999E) Oil (96.9%), Natural Gas (3.1%), Coal

(0.0%)

Renewable Energy Consumption (1998E) 2.9 trillion Btu* (60% decrease from 1997)

Number of People per Motor Vehicle (1998) 6 (vs. U.S. value of 1.3)

Status in Climate Change Negotiations Non-Annex I country under the United

Nations Framework Convention on Climate

Change (ratified May 29th, 1997). Not a

signatory to the Kyoto Protocol.

Major Environmental Issues Industrial pollution; limited natural fresh

water resources; limited land availability

presents waste disposal problems; seasonal

smoke/haze resulting from forest fires in

Indonesia.

Major International Environmental

Agreements

A party to Conventions on Biodiversity,

Climate Change, Endangered Species,

Hazardous Wastes, Law of the Sea, Nuclear

Test Ban, Ozone Layer Protection and Ship

Pollution.

4

* The total energy consumption statistic includes petroleum, dry natural gas, coal, net hydro,

nuclear, geothermal, solar, wind, wood and waste electric power. The renewable energy

consumption statistic is based on International Energy Agency (IEA) data and includes

hydropower, solar, wind, tide, geothermal, solid biomass and animal products, biomass gas

and liquids, industrial and municipal wastes. Sectoral shares of energy consumption and

carbon emissions are also based on IEA data.

3.0 COMPETITIVE ENVIRONMENT

3.1 Major Players in the Market

Major players in this market are mainly government owned companies or foreign companies.

These are consultants, waste management companies, infrastructure development,

environmental engineering, products and services related companies.

Some of the major players in Singapore are:

• Altvater Jakob (Germany),

• Endress+Hauser (SEA) Pte Ltd (Holland),

• Binnie Black & Veatch (SEA) Pte Ltd (USA),

• Montgomery Watson Asia (USA),

• Belt Collins (USA),

• Edeleanu Asia Pte Ltd (Germany),

• Shimadzu (Asia Pacific) Pte Ltd (Japan),

• Dredging International Asia Pacific Pte Ltd (Belgium),

• Sembcorp Waste Management Pte Ltd (Singapore),

• SEMAC Pte Ltd (Singapore),

• Singapore Environmental Management & Engineering Services Pte Ltd (Singapore),

• Intraco Ltd (Singapore),

• Natsteel Envirotech Pte Ltd (Singapore), and

• Eco Industrial Environmental Engineering Pte Ltd (Singapore).

3.2 Distribution Channels

Distribution can either be direct, through a representative, or by setting up a base in

Singapore (commonly through a joint venture partnership.) Singaporean companies are

often much more comfortable dealing with a local representative than direct.

3.3 Pricing

Major projects are usually through open tender where price and capability of the applicant is

of prime interest. Despite price being an important cog in the procurement process, New

Zealand companies should also emphasise quality products and after-sales service.

5

4.0 REGULATORY OVERVIEW

4.1 Duties/Taxes

Singapore is a duty free port, however a 5% Goods and Services Tax (GST) is applicable to

all goods and services sold in Singapore.

4.2 Regulatory and Licensing Restrictions or Difficulties

Singapore is a transparent market, and in general terms there are few restrictions on the

entry of goods. Product standards are often the same, or similar to, those enforced in the UK

and to a lesser degree, the United States.

Local companies involved in environmental technology need to be certified by approved

agencies like the Singapore Productivity and Standards Board (PSB). There are 16

organizations, including the PSB and the Building and Construction Authority, that can certify

companies as being environmentally friendly.

4.3 Quotas

Not applicable.

5.0 RECOMMENDED STRATEGIES

5.1 Possible Points of Differentiation for New Zealand Companies

New Zealand has a reputation as a nation with substantial natural resource and

environmental awareness, however education may be required in some instances to convey

the depth of technological expertise within the private sector. Singaporean companies are

familiar with the options presented by larger European or North American organisations, yet

the flexibility, ingenuity, quality of New Zealand companies needs promotion.

The relatively recent Free Trade Agreement between the two countries places a further

incentive for bilateral trade in products and services.

5.2 Tactical Recommendations on Market Entry

With emerging consciousness among Asia Pacific countries on the need to balance

economic development with environmental protection, New Zealand companies can use

Singapore as a base from which to market and provide their environmental engineering

services to the region and exchange skills and expertise in environmental management and

protection.

6

5.3 Recommendations on Long Term Strategic Issues for Exporters to Consider

Business in Singapore is highly relationship dependent. New Zealand companies should

take a long-term view when forging partnerships and be prepared for bilateral exchanges.

Many Singapore companies have extensive links into the Asian region that can be tapped for

future market development.

Prepared by: New Zealand Trade & Enterprise Singapore

November 2006

While every effort is made to ensure the accuracy of the information contained herein, New Zealand Trade and Enterprise, its

officers, employees and agents accept no liability for any errors or omissions or any opinion expressed, and no responsibility is

accepted with respect to the standing of any firms, companies or individuals mentioned. New Zealand Trade and Enterprise

reserves the right to reuse any general market information contained in its reports.

Submitted by Singapore

AIM

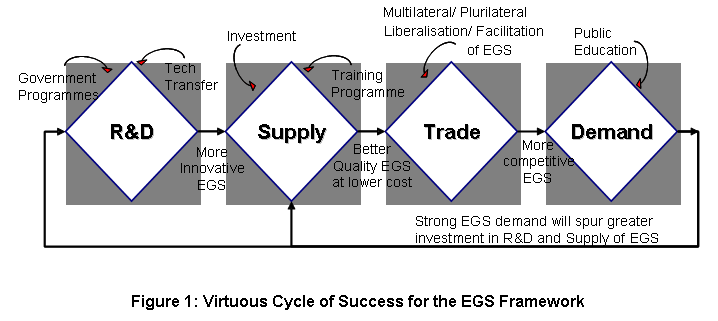

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...